How to Negotiate a Home Buyer Rebate with Houston Real Estate Agent

February 26, 2022

How do I get a home buyers rebate?

Buying a house is both an exciting and stressful process because of the huge commitment that homeowners must make, especially in big cities like Houston. They must not only pay the purchase price, but they must also cover any inspection charges, save for closing costs, and potentially even engage a real estate lawyer. The good news is that there is a method to get part of this money back — it’s known as a home buyer rebate. According to the United States Department of Justice, forty states, including Texas, allow real estate salespeople to provide customers with rebates. After reading this, you might want to get rebates as well.

A home buyer rebate, also known as a commission rebate, is when a buyer’s agent or broker divides a 50% percentage of the money they get on a transaction after the house is sold. Home Buyer rebates save you hundreds of dollars when purchasing a house.

Buyer rebates, for example, are only authorized in certain jurisdictions and on specific sorts of transactions. Home Buyer rebates are also subject to lender approval. They are often granted in the form of closing credits that can only be used to settle closing expenses or purchase mortgage points.

How to find an adequate agent for a home buyer rebate in Houston?

Negotiate one-on-one

The amount of the rebate you obtain will ultimately be determined by the strength/background of your bargaining capabilities. Doing one-on-one negotiation is the hardest way especially if you have many agents in the loop offering you different rebates.

If you’re a risk-taker and want to pursue this path, here are some more suggestions to get you started:

Be comfortable with leaving the deal

The person with the least concern has the most influence. It’s critical not to come out as desperate for a bargain. If you buy a vehicle or a house the first time you see it, you’ve almost certainly overpaid.

Search around

Keep searching! if someone does not give you what you desire. E.g., you’re looking for a good bargain on a loan? If a bank is not cooperating, consider a competitive nationwide mortgage business. Speak with your friends, family, and neighbors. How did they find the experience? Have they been in a scenario like this before? Have they ever bargained over anything, such as closing costs?

Ask

Almost everything in life can be bargained for. Try using “I statements” instead of “You statements.” Being assertive and aggressive is not the same thing, so try to put your points instead of forcing them. Think critically and question assumptions based on what you’ve been taught or told. How can you know if they claim to have the greatest title company?

Aim High

Aim high! if you want to get a rebate of 5%, ask for 8%. Be good at bargaining and making your opponent feel that they are winning.

Listen

Inquire probingly. Then, listen to comprehend the other person rather than convey your message. Use the 70/30 rule after asking open-ended questions. Listen 70% of the time and avoid asking questions that can be answered with a yes/no answer.

Use a service that will negotiate from your end

If you do not believe that you are confident enough or do not have the time to go out into the field and find the finest choice for yourself in a big city like Houston. In that case, you may hire an agent or an agency to conduct the process and find the best alternative for you.

Do some research on which agent offers the highest rebate. Check their website, check online reviews, talk over the phone call to check what they have to offer you. Keep in mind, though, that they will charge a commission. Do remember every agent or agency has its own work policies that you must know before signing them.

How much can you save with home buyer rebates?

The amount you save will be determined by the purchase value of the home and the percentage of the rebate that an agent offers.

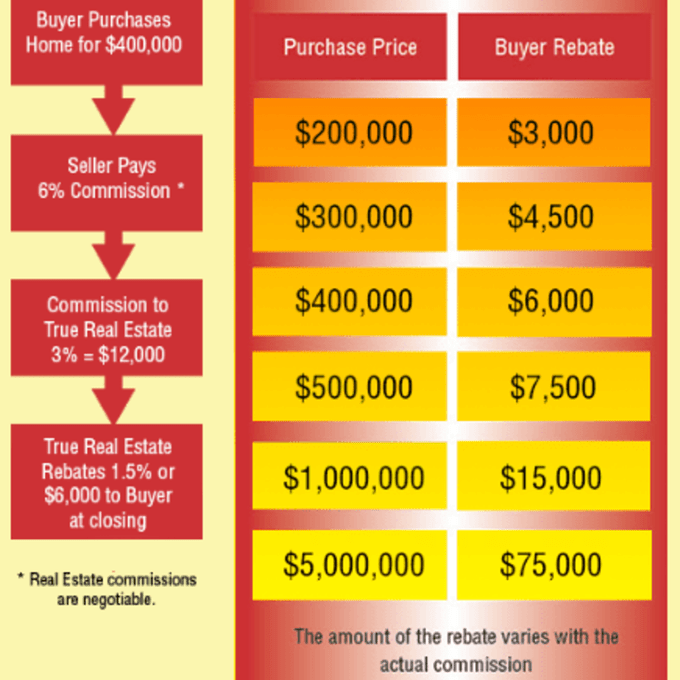

To explain it better, let us take an example. Imagine you are preparing to buy a $400,000 property in Houston, the seller pays a 6% fee as a commission Which is split evenly between the buyer and seller’s agents.

So, if your agent earns a 3% commission, i.e., $12000, you will save $6000 if the agent has offered you a 50% rebate on his commission. Isn’t it amazing?

Getting a good rebate can be a winning situation for you, but having an agent consulting you in buying or selling a house is more valuable than a rebate in your bucket.

Top real estate agents can add more value to the total cost of your property by using their strong negotiating skills and utilizing market knowledge to ensure a buyer or a seller get a valuable deal.

If you are looking for an agent who can get you the house of your dream at a maximum rebate, contact, the Jay Thomas Real Estate team. The team believes in providing affordable homes and luxury properties where you get a 50% commission REBATE at the final closing cost and is adjusted in the final purchase price of the property. The Department of Justice has created a rebate calculator that can be used to calculate the rebate.

Hello! I’m Jay Thomas, a REALTOR in Houston, Texas. Chances are you and I share a similar passion, Real Estate! I also have a passion for building businesses, working out, inspiring others, technology, sports, and people. Connect with me on Facebook and Instagram!

Hello! I'm Jay Thomas,